Buying or selling a property is a significant milestone and a high-stakes financial endeavour. There are risks to contend with, legal jargon to navigate, and compromises to be made. At times, it can feel like walking a tight rope, but the hard work is worthwhile when all the pieces fall into place.

To protect your interest and help you claim or transfer ownership of a property, you need a legal professional in your corner. Usually, that means hiring a conveyancer, a qualified expert who specialises in real estate law. Conveyancers can help you through the settlement process, but that doesn’t necessarily mean you should engage a conveyancer at the very last minute.

If you are wondering, “When should I contact a conveyancer?” or want to know how it takes for a conveyancer to review a contract when buying a house, this article is for you. Below, we’ll explore what a conveyancer does, when to get a conveyancer, and how to choose a trustworthy and competent conveyancer. Let’s get started.

What is a conveyancer?

The legal process of buying or selling property – whether that’s a house, apartment, or block of land – is called conveyancing. A conveyancer is a qualified professional who understands the ins and out of property sales and the related laws. There are some similarities between conveyancers vs solicitors in terms of the legal services they provide for property, but conveyancers exclusively specialise in facilitating the property transfer process.

The rules surrounding conveyancing vary from state to state. For example, as a seller in New South Wales, Victoria, or Tasmania, it’s recommended you engage a conveyancer before you list your property for sale. However, in Western Australia and Queensland, you don’t need to contact a conveyancer until you accept a buyer’s offer.

As a buyer, there are no specific rules about working with a conveyancer on your property hunt. However, a conveyancer can do more for you than sort out your paperwork – they can offer invaluable advice and property information that could help you avoid a financial disaster.

What does a conveyancer do?

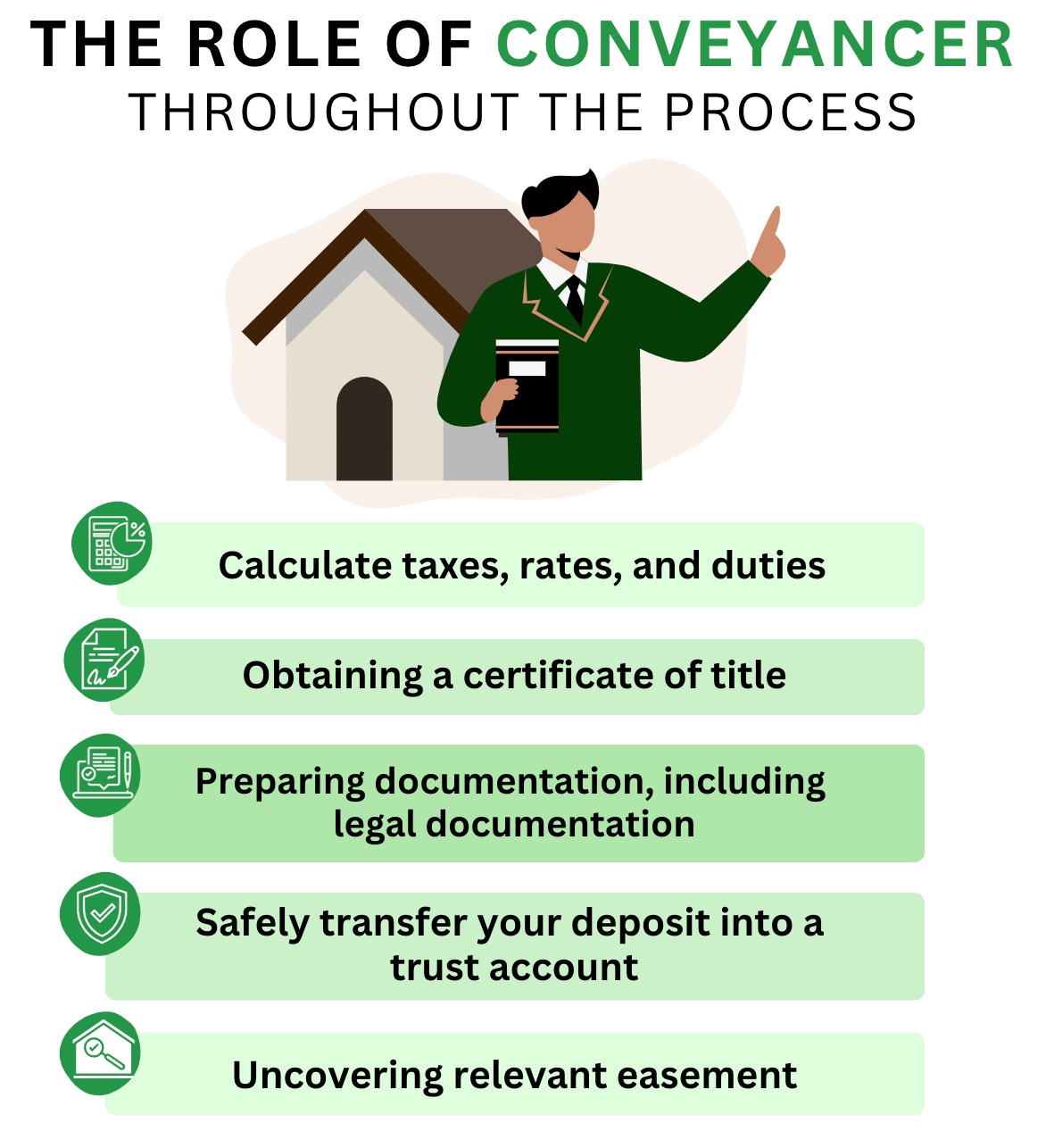

A conveyancer plays a key role throughout the buying or selling process, providing services that include:

- Accurately calculating rates, taxes, and duties (such as stamp duty)

- Liaising on your behalf with real estate agents or sellers

- Obtaining a certificate of title to ensure the seller can rightfully sell the property

- Preparing documentation, including legal documentation

- Providing advice about the property

- Safely transferring your deposit into a trust account

- Uncovering relevant easements (the ability to use an area of land in a specific way)

In addition to the above, conveyancers can perform specialty duties on a case-by-case basis. For example, they can help you navigate the legal requirements associated with a deceased estate.

Can I do my own conveyancing?

While it is possible, it is not recommended. If you decide to take the DIY conveyancing route, you will be penalised for any mistakes you make or details you miss. Oversights are very likely if you are not familiar with conveyancing laws. Finally, to add fuel to the fire, each state and territory in Australia has different conveyancing laws and requirements.

How much does a conveyancer cost?

Conveyancer fees differ depending on the nature and complexity of your situation. You can expect to pay between about $400 and $2,200. If you would like a personalised, obligation-free quote, fill out the form on this page. At Entry Conveyancing, our services come at fixed prices with no hidden costs or extra fees, which means more cash in your pocket.

When should I contact a conveyancer?

So, you’ve decided to buy or sell a property. Now, you’re wondering, “When should I contact a conveyancer?” While there is no one-size-fits-all answer to this question, most states recommend hiring a conveyancer before you begin the selling process and at the point of making an offer if you are buying. That’s the short answer.

If you’re asking when to get a conveyancer involved or when to engage a conveyancer when buying a house, the longer answer comes down to personal preference. Crucially, a conveyancer can reveal insights about a property or transaction that you might not have uncovered yourself. This information will protect your financial interests and sometimes be enough to see you walk away from a deal.

In addition, conveyancers can help you fulfil your legal responsibilities, ensuring you aren’t penalised for any missteps or oversights. For example, a potential buyer has the right to know about any easements on the property. You are legally liable if you fail to disclose this information – whether intentionally or by mistake.

When do I engage a conveyancer when buying a house?

As mentioned above, you can engage a conveyancer at any stage throughout the homebuying journey. However, the sooner you contact a conveyancer, the more certain you can be that the property is right for you. Remember, a conveyancer works for you – not the vendor. They will protect your best interests and can even discuss legal matters with agents and sellers on your behalf, giving you total peace of mind.

When to get a conveyancer when buying land?

Just like purchasing a house, you will need to enlist the help of a conveyancer to buy a block of land. The land buying process can be a little more complex, so you might benefit from contacting a conveyancer sooner rather than later.

For example, say you want to purchase a particular block of land to build a modern, single-storey home on. But when you hire a conveyancer to investigate the land, they find that the site is subject to covenants that will restrict your vision. In an extreme situation, they may even reveal that the land does not have the approval to be developed. In light of these findings, you decide to retract your offer and continue the search, saving yourself money, stress, and heartache.

When to get a conveyancer involved for an auction?

More and more sellers are choosing to take their properties to auction. According to CoreLogic, 42,918 properties were auctioned across Australia’s capital cities from October to December 2021. This figure was up 85.1 per cent from the previous quarter and a staggering 109.5 per cent from the same period in 2020.

If you are serious about purchasing a property at an upcoming auction, you will need to engage a conveyancer before auction day. Why? Because before you attend a property auction at which you intend to bid, you must have a copy of the contract of sale.

A conveyancer will examine the contract, detail any risks with the property, and help you negotiate changes prior to the auction. For example, you might request a shorter settlement date or a reduced deposit amount. That way, come auction day, you can bid confidently, knowing precisely what you are getting yourself into.

When should I contact a conveyancer? Before or after making an offer?

When should I contact a conveyancer? Before or after making an offer on a property? The answer is either. You can contact a conveyancer before making an offer or after your offer is accepted.

When making your decision, consider the benefits of calling a conveyancer beforehand. A conveyancer does more than review the contract of sale. They uncover hidden charges, such as unpaid rates. They reveal future government developments that may impact your quality of life or future property value. They shed light on the risks specific to you and the types of properties you are interested in purchasing, putting you in a favourable position as you embark on your search.

How do I choose a conveyancer?

Choosing the right conveyancer is a critical step in your buying or selling journey. First and foremost, ensure they are qualified and licensed according to the regulations and laws in your state or territory.

Then, find out what their fee structure is. Some conveyancers offer too-good-to-be-true prices, only to bolt on fees and charges after all is said and done. At Entry Conveyancing, our prices are fixed, which means you can proceed stress-free.

Finally, check their reputation by reading reviews and testimonials. A conveyancer can promise the world, but if they can’t deliver on those promises, they aren’t worth your time. You can read Entry Conveyancing’s five-star Google reviews here.

Ready to get started?

We’re here to help. If you have decided to buy or sell property, we are ready to roll our sleeves up and do the hard work for you. We understand the value of a home – not just financially but as a place where memories will be made and families will grow. That’s why we make your property our priority, commit to transparency, and personalise our approach.

With years of experience across all Australian states, Entry Conveyancing is home to your local experts wherever you plan to buy. So get started today with a free, no-risk quote. Or, if you have any questions or concerns, get in touch on 1800 518 187 or info@entryconveyancing.com.au. We’d be more than happy to assist.