In Australia, it’s considered best practice to engage a conveyancer in the process of a property transaction. While many property buyers and sellers are aware of this, few actually understand the vital role of a conveyancer in ensuring a smooth transaction.

Unlike the sale of other personal items and assets, real estate transactions are required to abide by strict legal regulations set in place by the government to ensure that the process is carried out fairly and in accordance with Australian property law. Put simply, conveyancers help to facilitate the transaction in accordance with these regulations to help parties avoid disputes and complications that can often be costly and time-consuming.

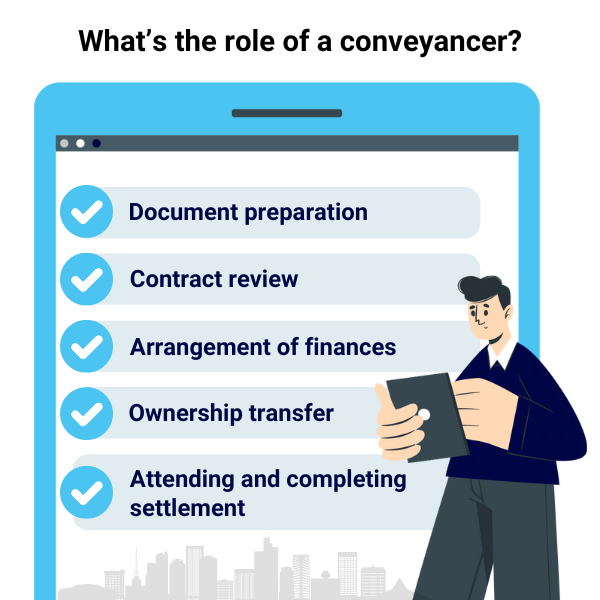

What are the responsibilities of a conveyancer?

A conveyancer is responsible for ensuring the legal compliance of the parties represented in line with property law. At each stage of the property transaction process, conveyancers carry out certain actions and tasks (often on behalf of represented parties) to protect the client’s interests and ensure that every detail is legally sound.

Here’s a breakdown of the specific responsibilities of a conveyancer at each stage of a property transaction.

Document preparation

A conveyancer is responsible for drafting all of the legal documentation required for a real estate transfer, such as the contract of sale, transfer of title, and settlement agreements. As part of the preparation process for these documents, a conveyancer will carry out title and property searches to ensure that the listed property and its accompanying details comply with all legal requirements of the state and local council. These searches can often take up the bulk of the conveyancing process, depending on the complexity of the property ownership and sale requirements.

Contract review

A conveyancer is also responsible for reviewing the contract of sale for the transaction, which includes any special conditions in addition to the usual or basic terms of sale. Special conditions of a contract have large cost and legal implications, which is why a conveyancer is required to provide clarity on what the buyer or seller will be agreeing to upon signing the contract.

Arrangement of finances

A conveyancer can make the necessary arrangements for obtaining funds for a deposit (for buyers) or to recoup property expenses such as advanced payments for council rates (for vendors). This will reduce the likelihood of delays in the settlement process later on.

Ownership transfer

A conveyancer will prepare all necessary transfer paperwork required for a property, whether commercial or residential, to be lawfully transferred into the buyer’s name. These documents include all information required to comply with state legal requirements, ensuring that the transfer of ownership is valid and legally binding. This step is essential in the legal process, as it ensures legitimate ownership of the property.

Attending and completing settlement

On settlement day, a conveyancer will attend the meeting on behalf of clients to carry out all required actions to complete the transaction — this includes making payment for the sale, the formal transfer of the property, checking required documents, and the delivery of keys to the new owner of the property.

Which party needs a conveyancer — buyers or sellers?

Both the buyer and the seller should engage their own conveyancer to manage their side of the property transaction and to protect their own interests.

For buyers, a conveyancer will be most involved with reviewing the contract of sale to make sure everything is accounted for according to the buyer’s requirements, as well as providing guidance on what to prepare or do at each stage of the process.

Conveyancers representing the vendor or seller will be responsible for preparing the contract of sale and other legal documents (including those related to property ownership) to make sure they accurately reflect the seller’s position, as well as offering support for resolving any disputes that may arise during the transaction.

Can a conveyancer provide assistance after a completed transaction?

Yes — in some cases, the role of a conveyancer extends beyond completed transactions to help buyers or sellers with post-settlement issues. Such issues are related to claims on the property such as warranty issues or disputes regarding parts of the property that have not been resolved to satisfaction.

Conveyancers can apply legal expertise to enforce the interests of buyers and sellers based on the contract of sale, ensuring that the necessary actions or reparations are taken to address any post-settlement issues.

Can you buy or sell a property without a conveyancer?

It’s generally advised against going through with a property transaction without the expertise of a conveyancer — parties that do so will expose themselves to significant legal and financial risk, especially if they do not have a proper understanding of the strict requirements of the transfer process.

If you are planning to sell or buy a property in Australia, choosing to work with a conveyancer will ensure that all legal and procedural aspects of the transaction are handled efficiently, protecting your interests and facilitating a smooth and successful transfer of property ownership. Entry Conveyancing has a team of Melbourne conveyancing solicitors, conveyancers in Sydney and Brisbane— get in touch with us today to find the right support for your property transaction.