You just put in the winning bid at an auction for the house of your dreams. After the excitement dies down you go home. But what do you do next?

For starters, when you buy a house at auction, or within three business days either side of an auction, you have no cooling-off period. So, unfortunately, if you bought a house with a fesnyng of ferrets living under it, you can’t give it back.

You do, however, have a three-day cooling-off period if you purchase a house or small rural property through a private sale. This means you have the right to change your mind, within three business days, about buying the property and can expect a full refund of any money you paid, less $100.

How long is sale to settlement?

The settlement period is the time between the day you sign contracts and pay a deposit, to the day you pay the balance of the purchase price and take possession of the property.

The number of days from sale to settlement vary between different states and territories, but generally it’s between 30 and 90 days.

During the settlement period, your bank and conveyancing solicitor will prepare to transfer legal ownership of the property to you. It’s important that you establish a working relationship with your solicitor prior to purchasing the property. This enables you to move ahead promptly once you’ve secured the sale.

If you don’t appoint a conveyancing solicitor before the sale, you may experience delays in the settlement because the processes involved can sometimes take longer than anticipated.

When you hire a solicitor to do your conveyancing, you’ll find they have a broad knowledge of the processes involved and the legal skills to deal with any complexities that may arise.

Licensed conveyancers are qualified to provide information and advice about conveyancing matters only. If more complicated legal matters develop that are outside the scope of conveyancing, you should ask to be referred to a conveyancing solicitor.

Settlement delays can be costly as well as inconvenient. You might have a removalist booked that you have to postpone, or you may need to pay to stay in a hotel until you settle on your new property. Or perhaps you’ve taken days off work for the move, and instead of drinking champagne on the floorboards you’re crying real tears into your takeaway coffee.

Your solicitor and bank may assume you don’t want to be involved in the preparations for settlement. Indeed, some buyers wait for the phone call to say settlement has occurred and then they collect the keys and move in.

Yet it may be wise to be involved and ensure there are no unnecessary delays. Keeping in touch with your solicitor and bank throughout the settlement period may help avoid disappointment.

What needs to happen during the settlement period?

The settlement period can be an uneasy time if you haven’t experienced it before. The best advice for a smooth and punctual settlement is to be proactive.

Don’t assume others will take care of every little thing. Ask questions, stay engaged and check with your bank and conveyancing solicitor that everything is on track for settlement day.

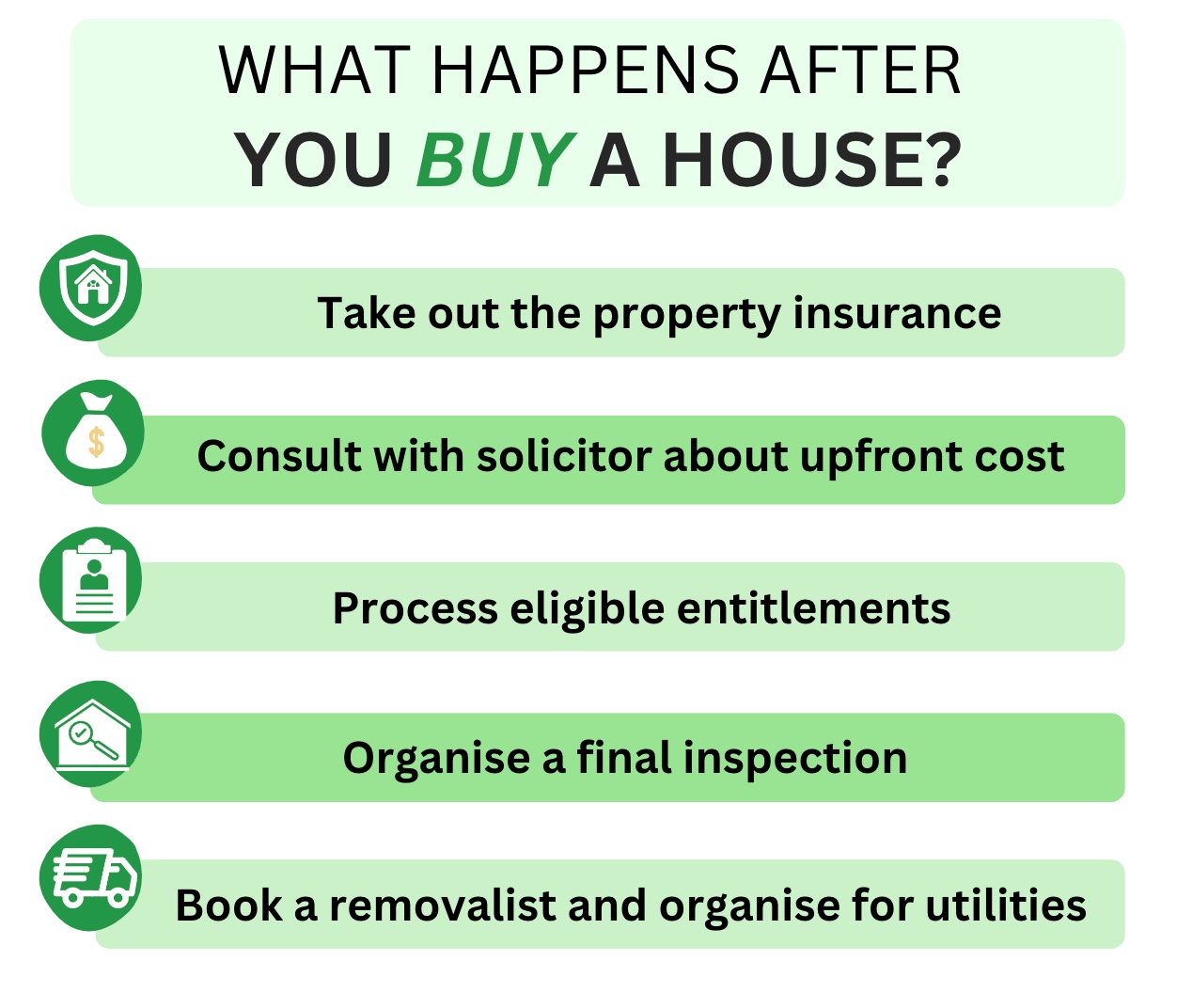

Your settlement checklist should include the following:

- Take insurance out on the property you’re purchasing. Check with your conveyancing solicitor whether you should start insurance from the date you sign the contract or the day of settlement, as it can vary between states and territories.

- Consult your solicitor about upfront costs and ensure you have enough finance to cover them. These costs include stamp duty, bank fees, solicitor fees and insurance. Council rates and other ongoing expenses are adjusted on settlement.

- If you’re eligible for any entitlements, such as the First Home Owner Grant, make sure they’re being processed in time for settlement.

- Organise a final inspection of the property. Do this inspection as close as possible to settlement day. If you discover any problems, let your conveyancing solicitor know.

- On your final inspection make sure fixtures, and any chattels the vendor has agreed to leave, are in place and intact. Also, check the boundary measurements correspond to the Certificate of Title.

- Book a removalist and organise for power, gas and internet to be turned on at the new property on the day you move in. Also redirect your mail to your new residence.

How does settlement happen?

On the day of settlement, your conveyancing solicitor, on your behalf, will pay the vendor the balance of the purchase price. Then you become the registered owner of the property and are provided with the property title.

Sometimes holdups, such as missing documents or minor bank errors, do occur but they can usually be rectified.

Your solicitor will ensure all future outgoings are handed over to you and that all current bills, such as water rates, land transfer duty and property taxes, are paid.

If you have a mortgage over the property, your lender will keep possession of the title until the mortgage is fully paid.

After settlement, you can go to the real estate agency and collect the keys to your new property.

E-conveyancing and how it works

Solicitors and conveyancers in Australia now have access to the national e-conveyancing platform, PEXA (Property Exchange Australia Ltd).

PEXA is an initiative by the Council of Australian Governments (COAG) to provide a national electronic platform for the Australian property industry.

PEXA tracks the progress of all parties, is more accurate than paper-based transactions and overcomes geographical barriers. It provides real-time lodgement of Land Registry documents and fast access to the proceeds of sales.

A free mobile PEXA app is available from the Apple Store for buyers and sellers to track the progress of their settlement online.

Check with your conveyancing solicitor whether they’ll use PEXA for your property settlement. Note, it’s not mandatory in all states and territories, and traditional conveyancing methods can still be used in some places.

What happens after settlement?

After settlement, you can sit back and enjoy your new home.

You should receive a final report of settlement from your conveyancing solicitor. You’ll also receive a letter from your bank confirming settlement has occurred, along with notification of your new home loan repayment schedule.

How we can help

At Entry Conveyancing, your conveyancing is managed by a senior conveyancing solicitor. We want to make sure our clients get the best service for straightforward conveyancing, and the best advice when more complex legal matters arise.

Now this might surprise you, but our conveyancing fees are competitive and affordable. It’s our policy to deliver the best service without the high prices, and we’ve worked hard to do it again.

Contact us today if we can help with your property conveyancing.