What is a section 32 vendor statement?

Buying property comes with inherent risk, and due diligence isn’t always enough to uncover details that might affect your decision. A section 32 statement – also known as a vendor’s statement – is a document that gives potential buyers critical information about the property and title before they sign the Contract of Sale.

Whether you are a buyer or seller, it’s essential to wrap your head around the main features of a section 32. Real estate can be complex, so it’s always recommended to have a qualified conveyancer prepare or review your section 32 statement.

What is a section 32 statement?

A section 32 document discloses information about the property that cannot be easily found during an inspection. It is prepared by the vendor (seller) for the buyer and must include information that could impact the state of the property, the plausibility of future works to the property, and other details that might affect the buyer’s decision – both whether to purchase the property and the sale price.

Section 32 is not the same as the Contract of Sale and must be provided by the seller before the Contract of Sale is signed.

Why is the section 32 real estate statement important to buyers and sellers?

Sellers are required under law to provide potential buyers with a section 32 document. It is a legal requirement, and if the seller refuses or produces an inaccurate or defective statement, there are significant and often costly consequences.

Section 32 is critical to the seller because if it is found to be incomplete – whether intentionally or not – the buyer may be able to break the Contract of Sale and walk away without financial penalty. In contrast, if the seller provides a complete and accurate vendor statement, they have the legal right to enforce the Contract. In addition, if the buyer changes their mind after the cooling-off period, the seller is entitled to keep the deposit.

Section 32 is critical to the buyer because if it is incomplete or defective, they may have grounds to walk away from the transaction without losing their deposit. Alternatively, an accurate section 32 statement provides vital information about the state of the property, information that will likely affect the decision-making process. By reviewing this document with help from a legal professional, buyers can avoid post-purchase surprises.

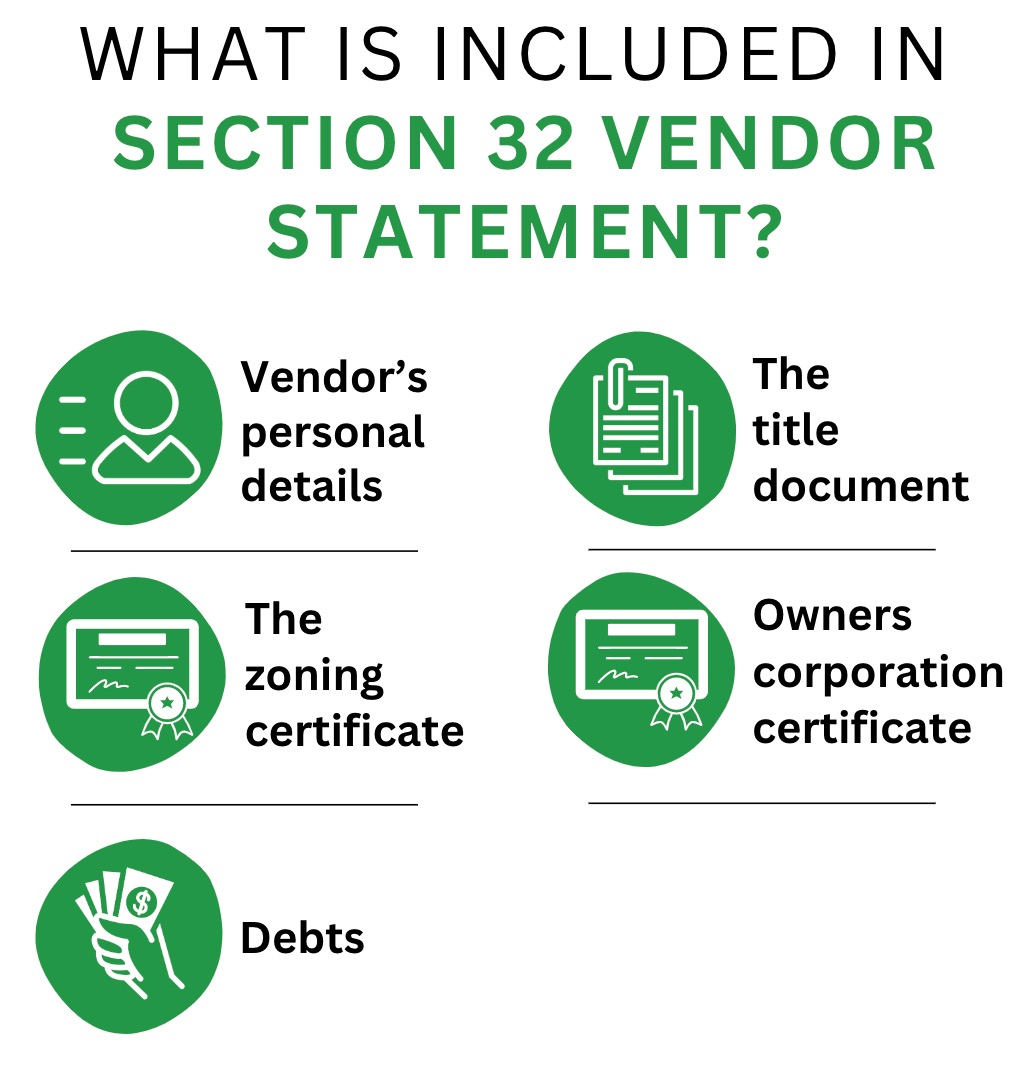

What does a section 32 include?

A section 32 statement is not, as the name might imply, a single statement. Instead, it is a group of documents related to the property and its ownership. Section 32s can vary, but some of the most commonly included documents are as follows:

The vendor’s personal details

This includes information about the vendor, such as their name, address, and contact number.

The title document

The title document proves that the seller actually owns the property and is authorised to sell it to a new owner. In addition, the title document includes several basic property details, such as the property type – house, block of land, etc. – and applicable restrictions. Restrictions cover things like covenants and easements, which outline specific ways areas of the land can and cannot be used, including building guidelines and limitations.

Notably, the title document discloses mortgages, charges, and other debts and liabilities related to the property.

The zoning certificate

Zones dictate how a property can be used or, in the case of a block of land, the types of premises that can be built. For example, a buyer may not be able to use a property in a residential zone for commercial purposes.

Debts

Outgoings on the property must be disclosed. This includes unpaid rates.

Owners corporation certificate

If the property is a strata-titled apartment or townhouse, the Owners Corporation Certificate gives buyers important information about the body corporate. This includes the financial position of the body corporate, maintenance fees, restrictions (e.g., whether pets are permitted), and any legal situations that impact the property.

What is not included in a vendor’s statement?

Buyers should keep in mind that a section 32 is not an exhaustive collection of relevant information – it doesn’t include the following:

- The condition of the building, including its structural integrity or any pest issues

- Whether the building complies with relevant and up-to-date codes and regulations

- The accuracy of information detailed in the title document

Who is required to sign the section 32 statement?

The section 32 document is prepared by the vendor, who must sign the document before giving it to a potential buyer. In some cases, real estate agents ask buyers to sign the document, too, as proof that it was provided and received.

Is a vendor’s statement required for all properties? What about private sales?

The vendor must provide a section 32 alongside the Contract of Sale, regardless of the property’s size, type, and intended use – whether a one-bedroom apartment in the city centre, a sprawling estate in the countryside, or a commercial warehouse. The buyer must have access to the section 32 before they sign the Contract of Sale.

In addition, a section 32 document is a legal obligation whether the sale is handled by a real estate agent or privately.

Does a lawyer need to prepare the section 32 vendor statement?

If you are a seller, you may wish to enlist the help of a conveyancer to prepare your section 32. A section 32 is required by law, and incomplete or inaccurate documentation can have severe consequences, financial and otherwise. You do not want to risk the sale of your property, and by working with a lawyer, you gain total peace of mind.

A qualified and experienced conveyancer understands your obligations as a seller. They know what is required, how to collect your documentation, and can check for accuracy and completeness. As a result, you can move ahead with your sale stress-free, knowing that if the buyer should change their mind, you have grounds to enforce the Contract of Sale.

Does a lawyer need to review the section 32 vendor statement?

If you are a buyer, it’s wise to seek a legal opinion before you sign the Contract of Sale. This applies whether you are a first-time buyer or a seasoned investor.

Property is one of the most significant purchases you will make in your lifetime, and cutting corners throughout the process can have devastating and far-reaching effects on your financial standing, lifestyle, and goals.

With a conveyancer in your corner, you can mitigate risk and ensure you pick up on important matters that could impact your buying decision. Remember, information is empowering, and the more you know about a property, the better your position to make an educated and beneficial choice.

Get support from the professionals

Whether you are a buyer or seller, it’s critical to have a legal professional by your side from the outset of your journey. Without a qualified eye, you risk overlooking vital information, which could significantly affect the sale and your financial position.

Contact the friendly and experienced team at Entry Conveyancing today on 1800 518 187 or at info@entryconveyancing.com.au and secure the peace of mind you need to take the next step. We’d be more than happy to ensure your purchase or sale goes as smoothly as possible.