Who pays conveyancing fees – buyer or seller?

Who pays conveyancing fees? Buyer or seller? The answer is both. Whether buying a property or selling one, you are responsible for engaging a qualified conveyancer and paying their fees. Why? Because conveyancing – the legal process of transferring property ownership – occurs on both sides of the transaction.

In this article, will dig deeper into the process, what it entails, and who pays for conveyancing. Let’s jump right into it.

Who pays for conveyancing?

Who pays conveyancing fees – buyer or seller? Does the seller pay conveyancing fees? Or does the buyer? Both parties are liable to pay their own conveyancing fees. If you are selling your home or investment property, you’ll need to enlist the help of a conveyancer. If you are buying a property, you’ll also need to call in and pay for a conveyancer.

Let’s backtrack. What is conveyancing?

Regardless of whether you’re buying or selling, you’ll need to pay for conveyancing. The question begs: What is it, and why does it matter?

Put simply, conveyancing is the legal process of transferring property ownership from one party to another. At first glance, it might seem as straightforward as changing the name on the title. But in reality, conveyancing law is complex, and there’s a whole lot of detail and precision that goes into accurately preparing all legal documentation.

One minor mistake can spell disaster, too, so it’s integral that you hire a trusted and reputable conveyancer to look after your interests.

So, what is a conveyancer? Are they the same as a solicitor?

A conveyancer is a qualified expert who guides sellers and owners through the settlement process and prepares the legal paperwork for property transfer. Conveyancers are not like real estate agents who list your property for sale or help you find a home that ticks all the boxes. Instead, they specialise in the legal side of the industry.

Conveyancers and solicitors are not necessarily the same thing. Some conveyancers are not qualified solicitors, while some qualified solicitors practise as conveyancers. While both are licensed to get the job done, solicitors have more training and education and a broader understanding of the law. Therefore, a solicitor practising as a conveyancer may offer higher quality services and greater peace of mind.

At Entry Conveyancing, our team of conveyancers are all qualified solicitors. This commitment gives our clients access to the best possible advice and guidance through what can be a high-stakes process.

What services do conveyancing fees cover?

Now that you know the answer to ‘Who pays conveyancing fees – buyer or seller?’, you might be wondering what you get for your money.

When you pay a conveyancer, you typically get all or most of the services required to complete the property ownership transfer – including all legal tasks.

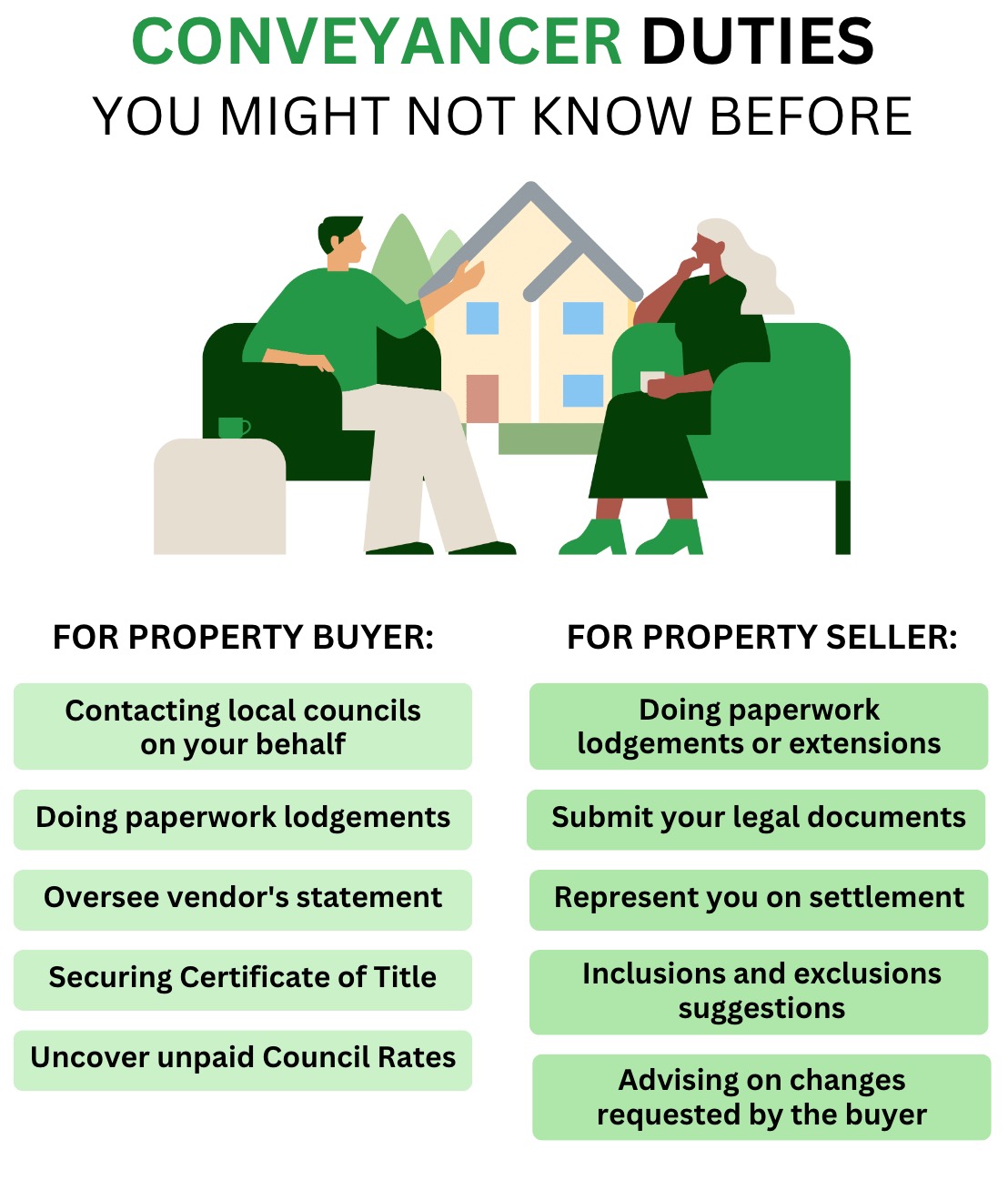

If you are the buyer, services included in the conveyancing fees will likely involve the following:

- Contacting local councils on your behalf to identify potential land development plans on or near the property you intend to purchase

- Handling your finances, such as taking care of the stamp duty payment and informing you where to put your deposit

- Meeting deadlines for paperwork lodgements or requesting extensions on your behalf

- Overseeing the Vendor’s Statement to ensure all details are accurate

- Preparing and submitting legal documents and explaining any documents prepared by the seller’s conveyancer

- Representing you on the day of settlement

- Reviewing the Contract of Sale, plus any recommendations or suggestions for inclusions or exclusions to meet your needs

- Scheduling property inspections

- Securing the Certificate of Title, which details the property’s ownership history, the type of title, and easements (which impact how you can use the property)

- Uncovering and following up on unpaid Council Rates

If you are the seller, the conveyancing fees you pay will likely cover the following:

- Meeting deadlines for paperwork lodgements or requesting extensions on your behalf

- Preparing and submitting legal documents and explaining any documents prepared by the buyer’s conveyancer

- Representing you on the day of settlement

- Reviewing the Contract of Sale, plus any recommendations or suggestions for inclusions or exclusions to meet your needs and explaining and advising on changes requested by the buyer

Do I need a conveyancer, or can I save money by doing it myself?

Who pays conveyancing fees – buyer or seller? Now that you know the answer, you might be tempted to take the DIY route. While it is possible to do your own conveyancing, one wrong move could cost you. And, unlike qualified conveyancers and solicitors, you are not covered by professional indemnity insurance. Instead, you may be 100 per cent liable for legal mistakes and mishaps.

In addition, conveyancers help you avoid common pitfalls. For example, when reviewing the Contract of Sale, they can make recommendations that’ll save you time, money, and effort. Say the garage of the property you plan on purchasing is packed full of the seller’s junk. If the contract doesn’t explicitly state that they must remove it prior to settlement, they may have no obligation to clear it out. Instead, it would be up to you.

Finally, inconsistencies, inaccuracies, and failure to comply with the law (whether intentional or not) can lead to the transfer falling through. Worst-case scenario, you may have to let go of your deposit. A conveyancer can help you avoid this financial disaster, giving you peace of mind.

Affordable fixed-fee conveyancing

Does the seller pay conveyancing fees? Who pays conveyancing fees? Buyer or seller? The answer is you. You pay conveyancing fees regardless of which side of the transaction you fall on. The good news? Conveyancing doesn’t have to run you over budget. At Entry Conveyancing, our solicitors offer their services for an affordable fixed fee – no unwanted surprises, guaranteed.

If you are ready to start your journey toward settlement with an expert in your corner, get a free quote today. We’d be happy to help you achieve your goals – whether you are buying your dream home or selling up and moving on.